.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

US$ 0 Trillion

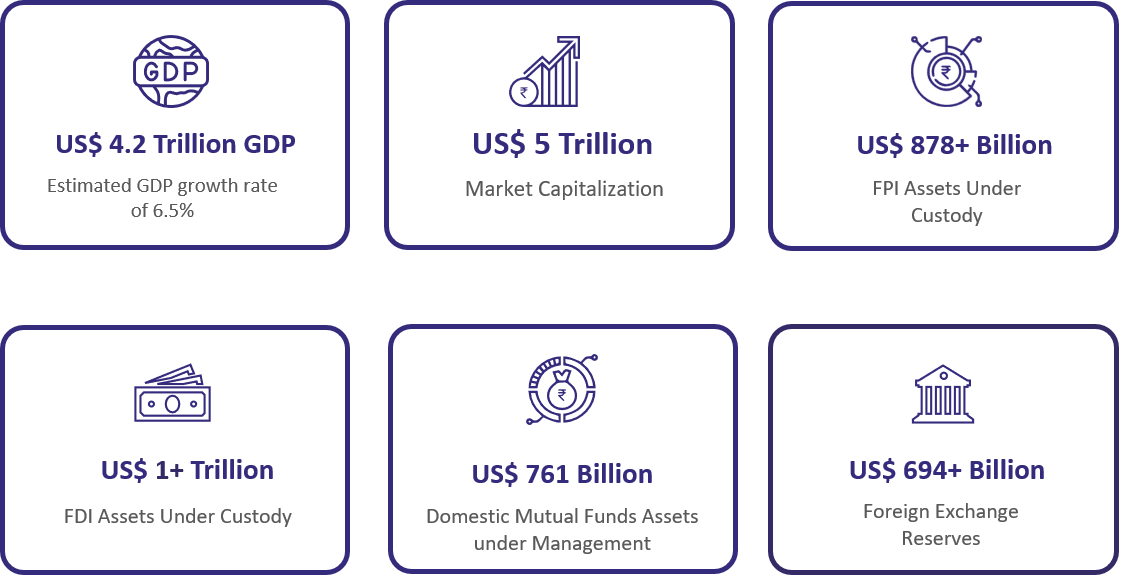

India - 4th largest growing economy

0

No. of FPIs registered as on date

US$ 0 Billion

Total FPI AUC as of August 2025

Tap into India’s Financial Pulse

Access to a High-Growth Emerging Market

India offers exposure to one of the world’s most dynamic emerging economies with long-term capital growth potential across multiple sectors.

Read MoreFavourable Regulatory and Tax Environment

India has streamlined its FPI framework to make entry, compliance, and tax structures more investor-friendly and efficient.

Read MoreDeep and Liquid Capital Markets

India’s capital markets provide FPIs with diversified and liquid instruments, enabling efficient portfolio construction and exit.

Read MoreMacroeconomic Stability and Reforms

India’s strong macroeconomic fundamentals and structural reforms support a stable investment climate for foreign capital.

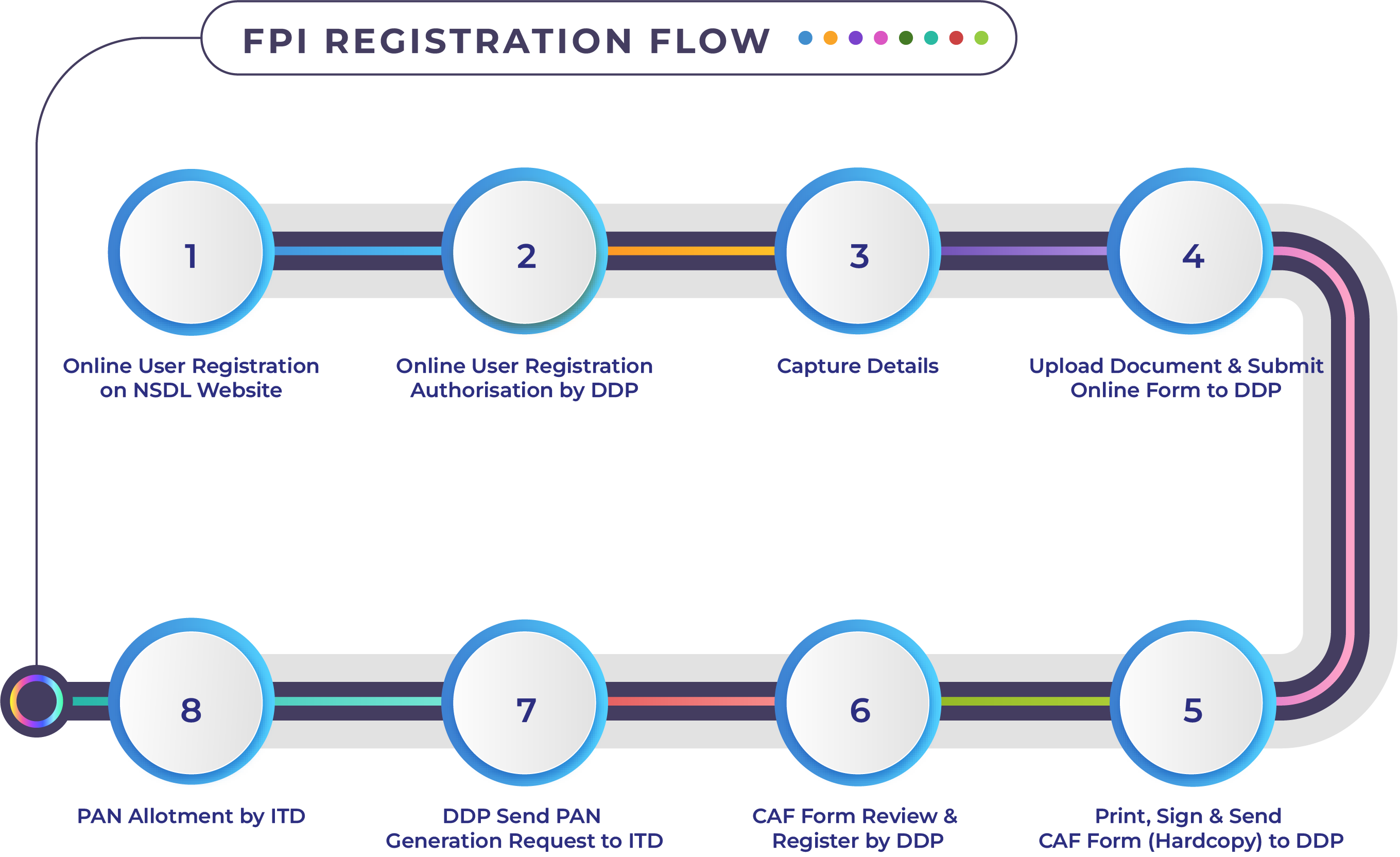

Read MoreForeign Portfolio Investor (FPI) Registration

Key Features

Introduction to Indian Markets

Read on to get a bird’s eye view of Indian Capital Markets covering Equity markets indices, fund flows in India and much more.

Explore MoreInvestment Opportunities

FPIs continue to have more than 1/3rd of the allocation in financials, followed by consumer discretionary and Information technology at 10-11% each.

Explore MoreRepatriation

Before remitting proceeds outside India, FPIs are required to discharge their Indian tax liability either by paying taxes prior to the remittance of funds or on a quarterly basis via advance taxes, whichever is earlier.

Explore MoreFPI Statistics

A comprehensive suite of data reports and disclosures, ensuring transparency and regulatory compliance in India’s foreign investment landscape.

Explore MoreObtain PAN – the Indian Tax ID

Permanent Account Number (PAN) is the tax registration number (ten-digit alphanumeric number) issued by the Income Tax Department (ITD) in India.

Explore MoreChanging Gears-India’s Market Reforms

India’s securities market has witnessed a wave of strategic reforms aimed at increasing efficiency, transparency, and investor protection.

Explore MoreFor any support, Please contact us!

SEBI acts as the primary regulatory authority for Foreign Portfolio Investors (FPIs)

The RBI governs the flow of foreign capital under the FEMA framework, setting macro-level policies and investment ceilings

The Income Tax Department ensures tax compliance for FPIs by regulating capital gains, interest, and dividend income