Clearing Corporations

“The Invisible Backbone: Ensuring Timely settlement & Market Integrity”

- Home

- Clearing Corporations

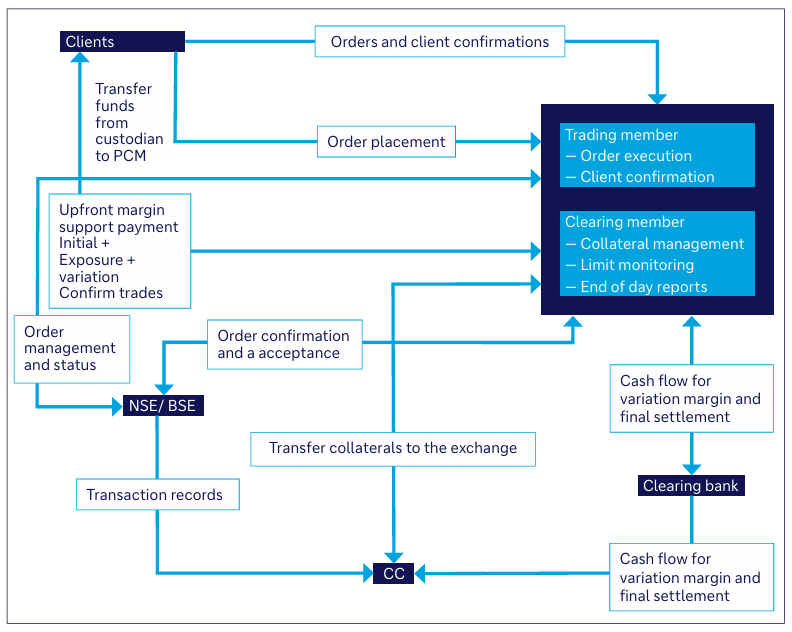

India’s capital markets are built on a robust market architecture anchored in transparency, investor-level protection, and settlement assurance. Central Counterparties (CCPs)/Clearing Corporations (CCs) lie at the heart of this architecture, ensuring guaranteed settlement of trades and acting as a critical link between trading and final settlement. Whether trades are executed on one or multiple stock exchanges, they are routed to the designated CCP for risk management, clearing and settlement, as selected by the clearing member/custodian for interoperable segments. This structure enhances operational efficiency while ensuring robust safeguards.

What sets India’s framework apart is its segregated market structure, as opposed to an omnibus model – a key distinction that sets us apart globally. In India, every trade is traceable to the ultimate investor, and each client’s assets and obligations are handled individually. This structure, though documentation-intensive, ensures transparency, enhanced investor protection, and superior asset security. By ensuring client-level visibility, collateral segregation, and risk containment, CCPs help protect investor assets from systemic shocks. They also provide flexibility for cross-utilisation of margins and facilitate operational efficiency through netting across exchanges.

The Indian CCP framework, through its emphasis on client-level clarity and control, underpins many of the market’s progressive reforms, KYC standards, investor protection policies, and more. Our CC’s are the silent enablers that transforms trade execution into assured settlement – ensuring market confidence, integrity, and continuity.

In essence, India’s CC’s architecture is not just compliant—it is confidence-building, offering global investors a secure, transparent, and future-ready market infrastructure.

List of CCP in IndiaAt the Heart of Every Transaction: The Four Pillars of a Clearing Corporation

Clearing Corporations (CCs) serve as the central nervous system of India’s financial markets, performing critical post-trade functions that ensure market integrity, transparency, and efficiency.

Safeguarding investor interests by collecting, allocating, and monitoring margins with client-level segregation.

- Clearing Corporation doesn’t accept collaterals directly from the End client.

- A clearing member/Custodian may deposit liquid assets in the form of cash, bank guarantees, fixed deposit receipts and approved securities and any other form of collateral as may be prescribed from time to time.

- These liquid assets are segregated as cash component and non-cash component. Cash component shall mean cash, bank guarantees, fixed deposit receipts, units of money market mutual fund, Gilt funds, Government of India Securities, Sovereign Gold Bonds and any other form of collateral as may be prescribed from time to time. Non-cash component shall mean all other forms of collateral deposits like deposit of approved list of demat securities, units of the other mutual funds, corporate bonds and any other form of collateral as may be prescribed from time to time.

- The total liquid assets comprise of the cash component and the non cash component. As per SEBI circular MRD/DoP/SE/Cir-07/2005 dated February 23, 2005 wherein the cash component shall be at least 50% of liquid assets. This implies that non cash component in excess of the total cash component would not be regarded as part of total liquid assets

- Cash

- Bank Guarantee

- Fixed Deposits

- Govt. Securities

- Equities

- Mutual Funds

- Corporate bonds

- Bullions

Acceptable forms of Collateral from Clearing Member/ Custodian is given below

Eligible Collateral

The types of liquid assets acceptable by CCs from the Clearing members/Custodians and the applicable haircuts and concentration limits are listed below:

| Collateral | Haircut | Concentration Limit | |

|---|---|---|---|

| Cash & Cash Equivalent | Cash | No haircut | Limit on the exposure to a single bank as stipulated by SEBI |

| Bank Guarantee (“BGs”) | No haircut | Limit on the exposure to a single bank as stipulated b y SEBI | |

| Bank Fixed Deposits Receipts (“FDRs”) | No haircut | Limit on the exposure to a single bank as stipulated by SEBI | |

| Units of liquid Mutual Fund (or) Mutual Fund (by whatever name called which invests in government securities) | 10% | Limit on the exposure to a single bank as stipulated by SEBI | |

Government Securities

|

Haircut as stipulated by SEBI | Limit on the exposure to a single bank as stipulated by SEBI | |

| Non-Cash Equivalent | Liquid (Group-I) Equity Shares (as per the criteria specified by SEBI for classification of scrips on the basis of liquidity). | VaR margin for the respective scrips | Member-wise/scrip-wise limits specified for each scrip |

| Mutual Funds (other than those listed under cash equivalent) | VaR | ||

| AA (or higher) rated Corporate Bonds | 10% | Total not to exceed 10% of the total liquid assets of the member | |

| Gold ETF (For commodity segment) | 20% | ||

| Bullion (For commodity segment) | 20% | As per SEBI stipulated criteria |

Anticipating and neutralizing potential defaults through robust real-time risk assessment tools.

- TMs/CMs/Custodian shall be exempted from collecting upfront margins in respect of Institutional transactions. Institutional transaction means transactions done on behalf of institutional investors. Institutional investors which includes Category I and Category II Foreign Portfolio Investors (who are not corporate bodies, individuals or family offices) as per SEBI FPI regulation 2019 (FPI)

- In respect of non-institutional custodial transactions, the margin collection and reporting shall be done by the Custodians for the margins applicable

- In respect of custodial transactions not allocated/rejected/not accepted by the custodians, such positions shall be considered as own transactions of the TMs who have executed the transactions and the margins shall be levied on such TMs

- The core of the risk management system is the liquid assets deposited by members with the Exchange/Clearing Corporation. These liquid assets shall cover the following margin requirements:

- MTM (Mark To Market) Losses including Intraday Crystallised Mark To Market Losses (ICMTM)

- VaR Margins

- Extreme Loss Margins

- The margins are computed and levied at a client (Custodial Participant code) level in respect of institutional transactions and collected from the custodians/members.

- The Clearing corporation (CC) has developed a comprehensive risk containment mechanism for the Futures & Options segment. The most critical component of a risk containment mechanism for CC is the online position monitoring and margining system. The actual margining and position monitoring is done on-line, on an intra-day basis. NSE CLEARING & ICCL uses the SPAN® (Standard Portfolio Analysis of Risk) system for the purpose of margining, which is a portfolio based system.

- Cross margining benefit is available across Cash and Derivatives segment

- Cross margining benefit is available to all categories of market participants including FPIs.

- For client/entities clearing through same clearing member in Cash and Derivatives segments, the clearing member is required to intimate client details to avail the benefit of Cross margining

- For client/entities clearing through different clearing member in Cash and Derivatives segments they are required to enter into necessary agreements for availing cross margining benefit.

- For the client/entities who wish to avail cross margining benefit in respect of positions in Index Futures and Constituent Stock Futures only, the entity's clearing member in the Derivatives segment has to provide the details of the clients and not the copies of the agreements. The details to be provided by the clearing members in this regard are stipulated in the Format.

Determining precise fund and securities obligations for every trade, across multiple trading venues & Ensuring guaranteed, timely delivery of cash and securities, enabling confidence in finality.

All trades executed on the floor of the stock exchange on day T (trade date) flow to the custodian/Clearing members for confirmation on day T. Custodians are required to confirm the trade to their designated CC for settlement by cut off time. There is cut off by when confirmation of trades needs to be done. All confirmed trades will be part of Custodian /Clearing Member’s obligation and will have to be settled by the custodian on T+1

Clearing & Settlement Timelines

| Sr No | Particulars | Activity | Equity | Equity Derivative | Currency Derivative | Interest Derivative | SLB |

|---|---|---|---|---|---|---|---|

| 1 | Trading | Trading Day (T) | T Day | T Day | T Day | T Day | T Day |

| 2 | Trading | Trading Time | 09:00 AM to 3.30 PM | 09:00 AM to 3.30 PM | 09:00 AM to 5.00 PM | 09:00 AM to 5.00 PM | 09:00 AM to 5.00 PM |

| 3 | Clearing | Custodial Confirmation | T +1 Day (7.30 AM) | T Day (4.15 pm) | T Day (5.30pm) | T Day (5.30 pm) | T Day (6.00 PM) |

| 4 | Settlement | Daily Funds Settlement Completion | T+1 working days (1.30 PM) | T+1 working days (9.00 AM) | T+1 working days (9.00 AM) | T+1 working days (9.00 AM) | T+1 working days (8.00 AM) |

| 5 | Settlement | Final Fund Settlement Completion | NA | E+1 working days (9.00 AM) | E+2 working days (9.00 AM) | E+1 working days (9.00 AM) | T+1 working days (8.00 AM) |

| 6 | Settlement | Final Settlement Securities Completion time | T+1 working days (3.30 PM) | * Netted with Equity | NA | NA | Expiry day 11.30 AM |

**On Contracts Expiry day, all open stock futures & all exercised Options contracts will result in securities delivery obligations. Delivery obligations will get netted with Equity cash settlement

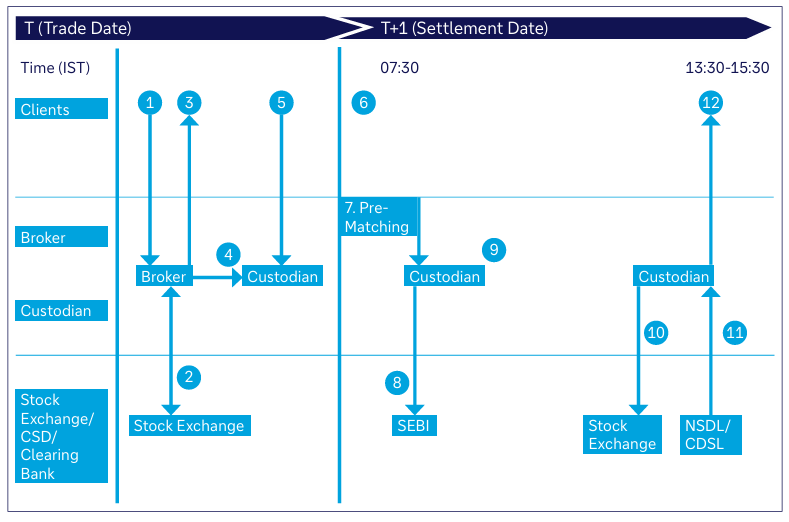

EQUITY SEGMENT

Purchase Trade Cycle

- Client sends trade instruction to the broker.

- Trade executed by the broker on the stock exchange

- Trade confirmation sent by the broker to the client

- The broker sends the Contract Note to the custodian, via STP gateway, on day T

- The client sends settlement instructions to the custodian on day T/ T+1 morning

- The client needs to arrange for INR funds for full settlement

- Pre-matching and trade confirmation done by 07:30 hours on T+1 by the custodian. For non-institutional clients’ trades, margins need to be collected upfront on T date, and trade confirmation to be done latest by 19:30 hours on T day

- Reporting of transactions to SEBI

- The client’s bank account maintained with the custodian bank debited for settlement funding on T+1; for non-institutional clients, the amount will be debited on T date

- Payment of settlement value to the exchange through the clearing bank

- Pay-out of securities via depositories and credited to the client’s security account maintained by the custodian

- Settlement confirmation sent to the client

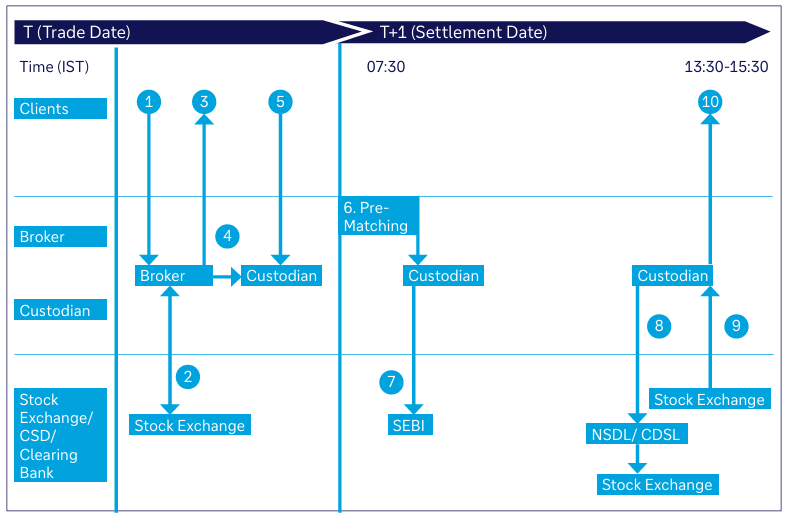

Sales Trade Cycle

- The client sends trade instruction to the broker

- Trade executed by the broker on the stock exchange

- Trade confirmation sent by the broker to the client

- The broker sends Contract Note to the custodian, via STP gateway, on day T s

- The client sends settlement instruction to the custodian on day T/ T+1 morning Pre-matching and trade confirmation done by 07:30 hours on T+1 by custodian. For non institutional clients’ trades, early pay-in of securities to be done on T date and trade confirmation latest by 19:30 hours on T day

- Reporting of transactions to SEBI

- Pay-in of securities by 10:30 hours to the depositories

- Pay-out of funds received via the clearing bank

- Credit proceeds to the client’s account

- settlement confirmation sent to the client

DERIVATIVE SEGMENT

- The positions in the futures contracts for each member is marked-to-market to the daily settlement price of the futures contracts at the end of each trade day.

- On the expiry of the futures contracts, the Clearing Corporation mark all positions of the Clearing Members to the final settlement price and the resulting profit/ loss is settled in cash.

- Premium settlement is cash settled.

- Final exercise settlement is in effect for option positions at in-the-money strike prices existing at the close of trading hours, on the expiration day of an option contract.

- Long positions at in-the-money strike prices are automatically assigned to short positions in option contracts with the same series, on a random basis.99

- Final settlement loss/ profit amount for option contracts on index contracts is debited/ credited to the relevant Clearing Member’s clearing bank account on E+1 day (E = expiry day).

- In respect of Stock derivative contracts all open futures positions after the close of trading on the expiry day & all in-the-money contracts which are exercised and assigned are physically settled.

- Open positions, in option contracts, cease to exist after their expiration day.

The settlement of trades is on T+1 working day basis.

Daily Mark-to-Market Settlement of futures contracts on index/ individual securities/Currency/Interest rate derivatives :

Final Settlement of futures contracts on index /individual securities/currency /interest rate derivatives:

Daily Premium Settlement of options derivative contracts:

Final Exercise Settlement of options contracts on index/ currency /interest rate derivatives

Final Exercise Settlement of options contracts on individual securities:

Position Limits for FPI Clients – Equity Derivative

| FPI Cat I | FPI II (Other than Individuals, family offices, and corporates) | FPI II (Individuals, family offices, and corporates) | |||

|---|---|---|---|---|---|

| Index Futures | Index Options | Index Futures | Index Options | Index Futures | Index Options |

| Higher of Rs.500 crores or 15% of the total open interest in the market index futures contracts. | Higher of Rs.500 crores or 15% of the total open interest in the market index option contracts. | higher of Rs.300 crores or 10% of the total open interest in the market | is higher of Rs.300 crores or 10% of the total open interest | is higher of Rs.100 crores or 5% of the total open interest in the market | is higher of Rs.100 crores or 5% of the total open interest in the market |

| Stock Derivative | Stock Derivative | Stock Derivative | |||

| 30% of the applicable Market Wide Position Limit per exchange | 20% of the applicable Market Wide Position Limit per exchange | 10% of the applicable Market Wide Position Limit across exchanges. | |||

In addition to the above limits, in index futures and options, FPI Category (I)/MFs shall take exposure in equity index derivatives subject to the following limits:

Short positions in index derivatives (short futures, short calls and long puts) not exceeding (in notional value) the FPI Category (I)/ MFs holding of stocks.

Long positions in index derivatives (long futures, long calls and short puts) not exceeding (in notional value) the FPI Category (I)/MFs holding of cash, government securities, T-Bills, money market mutual funds and gilt funds and similar instruments.

In this regard, if the open position of an FPI Category (I)/ MF exceeds the limits as stated for Index Futures or Index Options, such surplus would be deemed to comprise of short and long positions in the same proportion of the total open positions individually. Such short and long positions in excess of the said limits shall be compared with the FPI Category (I) /MFs holding in stocks, cash etc. as stated above.

The latest position Limits applicable for FPI client in stock derivatives is attached herewith.

Click here to DownloadPosition Limits for FPI Clients – Currency Derivative

| Product | FPI Category I and FPI Category II (other than individuals, family offices and corporates) | FPI Category II (individuals, family offices and corporates) |

|---|---|---|

| USD-INR | Gross open position across all contracts shall not exceed 15% of the total open interest or USD 100 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or USD 20 million, whichever is higher |

| EUR-INR | Gross open position across all contracts shall not exceed 15% of the total open interest or EUR 50 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or EUR 10 million, whichever is higher |

| GBP-INR | Gross open position across all contracts shall not exceed 15% of the total open interest or GBP 50 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or GBP 10 million, whichever is higher |

| JPY-INR | Gross open position across all contracts shall not exceed 15% of the total open interest or JPY 2000 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or JPY 400 million, whichever is higher |

| EUR-USD* | Gross open position across all contracts shall not exceed 15% of the total open interest or EUR 100 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or EUR 10 million, whichever is higher |

| GBP-USD* | Gross open position across all contracts shall not exceed 15% of the total open interest or GBP 100 million, whichever is higher | Gross open position across all contracts shall not exceed 6% of the total open interest or GBP 10 million, whichever is higher |

| USD-JPY* | Gross open position across all contracts shall not exceed 15% of the total open interest or USD 100 million, whichever is higher. | Gross open position across all contracts shall not exceed 6% of the total open interest or USD 10 million, whichever is higher. |

- In case of positions taken to hedge underlying exposure, the position limit linked to open interest shall be applicable at the time of opening a position. Such positions shall not be required to be unwound in the event a drop of total open interest in a currency pair at a stock exchange. However, participants shall not be allowed to increase their existing positions or create new positions in the currency pair till they comply with the position limits.

- FPIs may take long or short positions without having to establish existence of underlying exposure, up to a single limit of USD 100 million equivalent, across all currency pairs involving INR, put together, and combined across all the stock exchanges

- FPIs shall ensure that their short positions at all stock exchanges across all contracts in FCY-INR pairs do not exceed USD 100 million.

- To take long positions in excess of USD 100 million in all contracts in FCY-INR pairs, FPIs shall be required to have an underlying exposure in Indian debt or equity securities, including units of equity/debt mutual funds

- The Clearing Corporation shall provide details on the FPI’s day-end and day’s highest open positions at end of day to the custodians of the FPI.

- The custodian of the FPI shall aggregate the positions taken by the FPI on the currency derivatives segments of all the stock exchanges and forward such details to the designated bank of the FPI. The custodian of securities of the FPI shall also provide the market value of applicable underlying exposure of the FPI to the designated bank of the FPI.

- The onus of complying with the above provisions shall rest with the FPI and in case of any contravention, the FPI shall render itself liable to any action that may be warranted by RBI as per the provisions of Foreign Exchange Management Act, 1999 and Regulations, Directions, etc. framed thereunder. These limits shall be monitored by stock exchanges and/or clearing corporations and breaches, if any, shall be reported to RBI.

Position Limits for FPI Clients – Interest Rate Derivatives

| Product | FPI Category I and FPI Category II (other than individuals, family offices and corporates) | FPI Category II (individuals, family offices and corporates) |

|---|---|---|

| Across all contracts within the 8-11 year maturity bucket | 10% of Open Interest or INR1,200 crores whichever is higher | 3% of Open Interest or INR 400 crores whichever is higher |

| Across all contracts within other maturity bucket | 10% of Open Interest or INR 600 crores whichever is higher | 3% of Open Interest or INR 200 crores whichever is higher |

- The total gross short (sold) position of each FPI in Interest Rate Derivatives contracts shall not exceed its long position in the government securities and in Interest Rate Futures, at any point of time.

- A separate limit of INR 5,000 crores to FPIs for taking long position in Interest Rate Derivatives. This limit will be calculated as follows:

- For each Interest Rate Derivatives instrument, position of FPIs with a net long position will be aggregated.

- FPIs with a net short position in the instrument will not be reckoned.

- No FPI can acquire net long position in excess of INR 1,800 crores at any point of time.

- For monitoring the limit Stock Exchanges, after consulting amongst themselves, shall adhere to the following mechanism:

- Stock Exchanges will put in place necessary mechanism for monitoring and enforcing limits of FPIs in Interest Rate Derivatives

- Stock Exchanges will aggregate net long position in Interest Rate Derivatives of all FPIs taken together at end of the day and shall jointly publish/ disseminate the same on their website on daily basis.

- Once 90% of the limit is utilized, Stock Exchanges will put in place necessary mechanism to get alerts and publish on their websites the available limit, on a daily basis.

- In case, there is any breach of the threshold limit, the FPI/s whose investment caused the breach shall square off their excess position/s within five trading days or by expiry of contract whichever is earlier.

The following penalty shall be levied in case of short reporting by trading/clearing member per instance.

| Short collection for each client | Penalty percentage |

|---|---|

| (< Rs 1 lakh) And (< 10% of applicable margin) 0.5% | 0.5% |

| (= Rs 1 lakh) Or (= 10% of applicable margin) 1.0% | 1.0% |

If short/non-collection of margins for a client continues for more than 3 consecutive days, then penalty of 5% of the shortfall amount shall be levied for each day of continued shortfall beyond the 3rd day of shortfall.

If short/non-collection of margins for a client takes place for more than 5 days in a month, then penalty of 5% of the shortfall amount shall be levied for each day, during the month, beyond the 5th day of shortfall.

Notwithstanding the above, if short collection of margin from clients is caused due to movement of 3% or more in the Sensex/Nifty 50 (close to close) on a given day, (day T), and 1% or more in the currency pair - USD-INR only, then, the penalty for short collection shall be imposed only if the shortfall continues to T+2 day.

All instances of non-reporting are treated as 100% short reporting for the purpose of levy of penalty.

| Instances of Disablement | Penalty to be levied |

|---|---|

| 1st instance | 0.07% per day |

| 2nd to 5th instance of disablement | 0.07% per day + Rs.5,000/- per instance from 2nd to 5th instance |

| 6th to 10th instance of disablement | 0.07% per day + Rs.20,000/- ( for 2nd to 5th instance) + Rs.10000/- per instance from 6th to 10th instance |

| 11th instance onwards | 0.07% per day + Rs.70,000/- ( for 2nd to 10th instance) + Rs.50,000/- per instance from 11th instance onwards. Additionally, the member will be referred to the Member Committee for suitable action. |

Instances as mentioned above refer to all disablements during market hours in a calendar month. The penal charge of 0.07% per day is applicable on all disablements due to margin violation anytime during the day.

In case of violation of FII/Mutual Fund limits a penalty of Rs. 5,000/- would be levied for each instance of violation.

- Client wise/NRI/sub account of FII/scheme of MF position limit violation

In case of open position of any Client/NRI/sub-account of FII/scheme of MF exceeding the specified limit following penalty would be charged on the clearing member for each day of violation:

1% of the value of the quantity in violation (i.e., excess quantity over the allowed quantity, valued at the closing price of the security in the normal market of the Capital Market segment of the Exchange) per client or Rs.1,00,000 per client, whichever is lower, subject to a minimum penalty of Rs.5,000/- per violation / per client.

When the client level/NRI/sub-account of FII/scheme of mutual fund violation is on account of open position exceeding 5% of the open interest, a penalty of Rs.5000 per instance would be levied to the clearing member.

At the end of each day during which the ban on fresh positions is in force for any security, when any member or client has increased his existing positions or has created a new position in that security the client/trading members will be subject to a penalty 1% of the value of increased position subject to a minimum of Rs.5000 and maximum of Rs.100000. The positions, for this purpose, will be valued at the underlying close price.