Policy Making at SEBI

A holistic approach to policy formulation

- Home

- Policy Making at SEBI

SEBI is committed to a transparent, consultative, and structured policy-making process for India’s securities market. Our approach ensures that every regulation is well-informed, widely discussed, and consistently implemented.

How SEBI Formulates Policies:

A Step-wise Overview

SEBI’s policy-making journey begins with brainstorming and public consultation, followed by expert review and Board approval. Each stage is designed to ensure transparency, participation, and regulatory clarity. The process is as follows:

- Ideation & Internal Discussions

- Policy formulation starts with internal brainstorming and deliberations within focused Working Groups.

- Public Consultation

- Draft consultation papers are published on SEBI’s website, inviting feedback from the public, industry experts, and stakeholders. Click here to explore

- Policy Advisory Committees

- Advisory Committees review the proposals and public comments in detail. Click here to explore

- Board Deliberation & Approval

- A detailed Memorandum, explaining the regulatory intent and stakeholder feedback, is presented to the SEBI Board.

- Transparency in Decision-Making

- All Board Memoranda and meeting minutes are published online for public access. Click here to explore

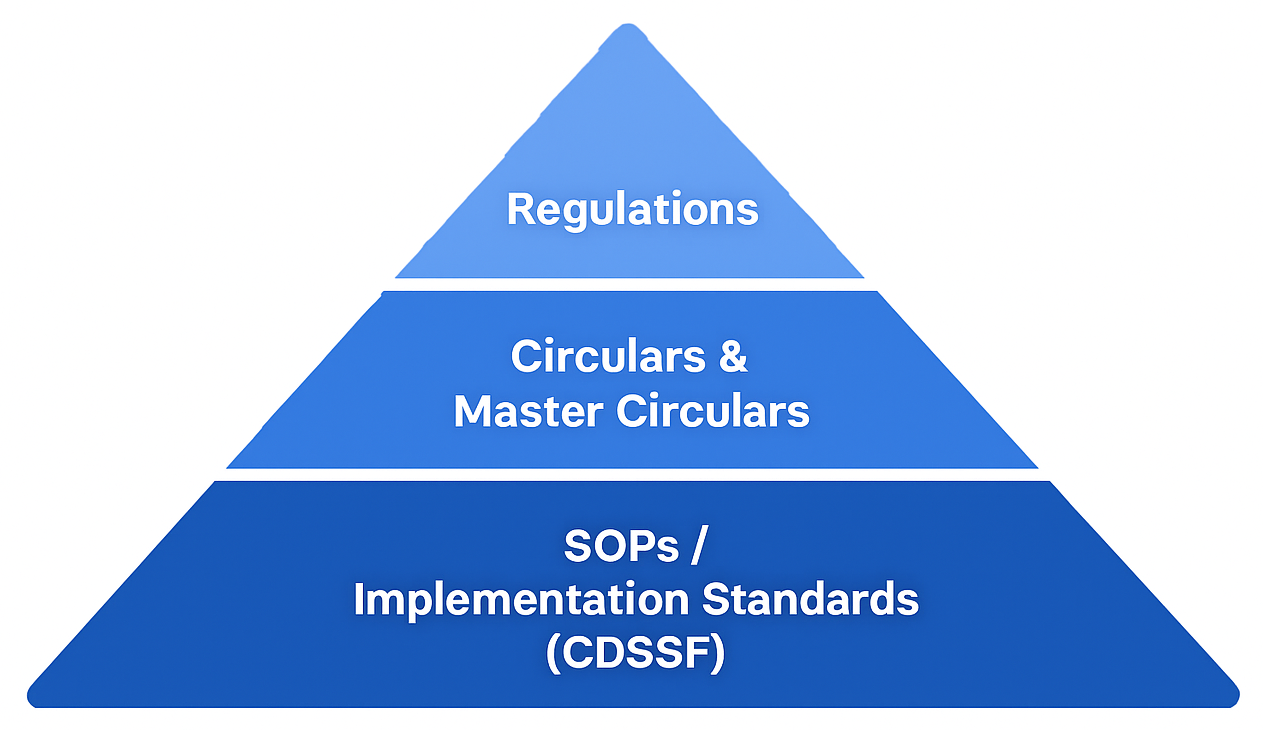

After policy approval, SEBI follows a three-tier framework for implementation. This structure ensures that every rule—from broad principles to operational details—is communicated and applied consistently across the securities market.

- Tier I: Regulations

e.g., SEBI (FPI) Regulations, SEBI (Custodian) Regulations

These form the broad legal framework

- Tier II: Circulars & Master Circulars

Periodic circulars detail operational aspects. An annual Master Circular consolidates all updates for easy reference.

- Tier III: Implementation Standards (SOPs)

The Custodians and Depositories Standards Setting Forum (CDSSF), in collaboration with SEBI, develops detailed SOPs (Standard Operating Procedures) for effective, consistent implementation.These form the broad legal framework

SEBI’s process ensures that:

- Multiple viewpoints are considered

- Market participants clearly understand and implement regulations

- The regulatory intent is always transparent and accessible